Whether you're a newlywed or a divorcee, financial issues are complicated. You may be wondering, "Do I need a financial advisor?" The first few years can be filled with new opportunities, and you will have a growing bank account. You may also be trying to figure out how to invest and divide the money. Or how to save the money you have earned. Your advisor can help guide you through the process based on years of experience and will make sure that the transition is smooth.

Financial advisors: Cost-benefit analysis

It is essential to determine whether you will receive more value from the services of a financial professional than from your own investment decisions by performing a cost/benefit evaluation. Lower investment returns are generally associated with lower costs. The quality of professional qualifications and resources is not always comparable to talent. Compare the benefits and costs of different financial advisors. Be cautious about those offering "free" services, or who provide evasive answers.

Financial advisors

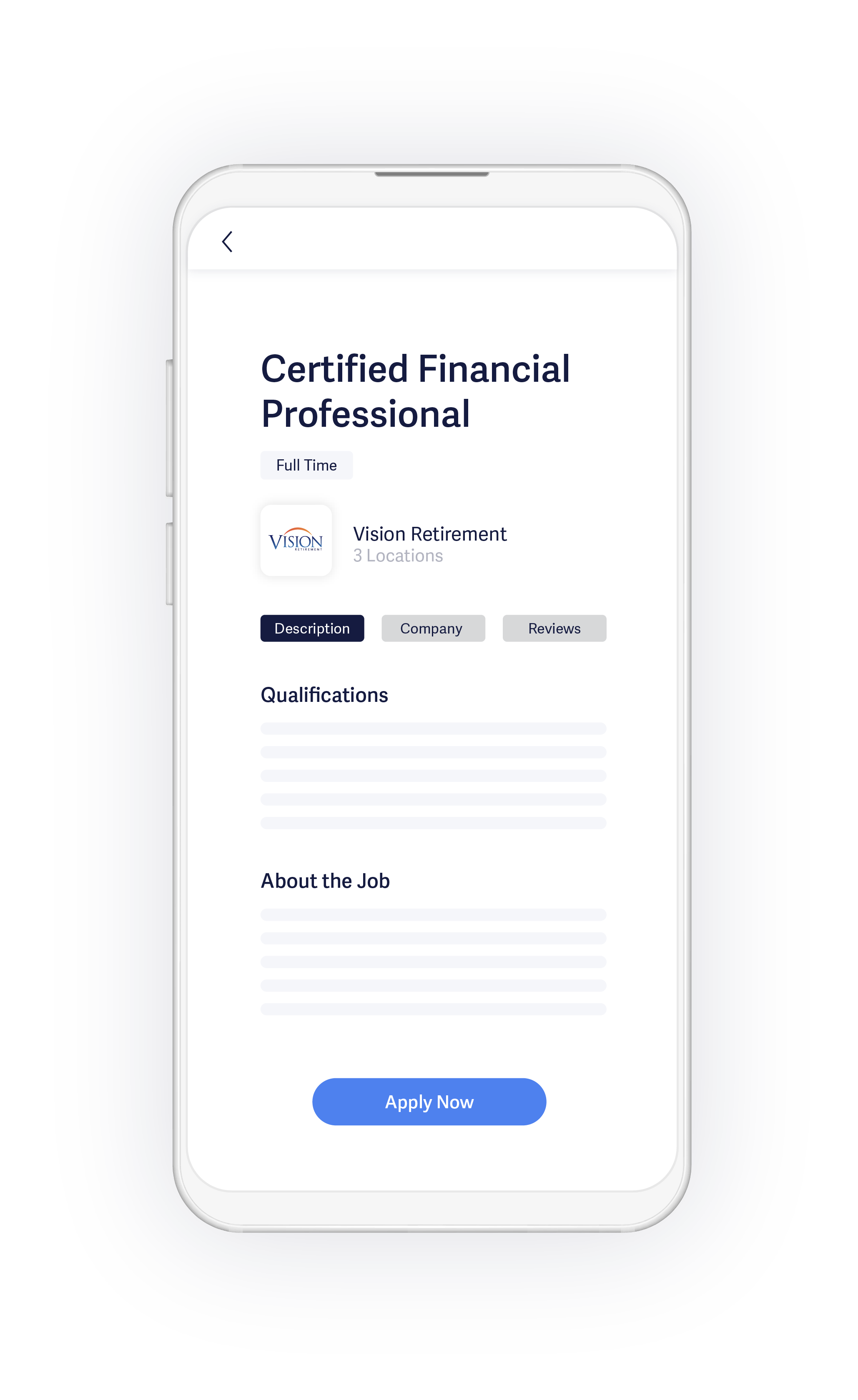

The most important thing to consider when choosing a financial advisor is how many years the professional has been in the field. While some advisors may only be skilled in investing, many others provide a range of financial planning services. These include retirement planning, estate planning and college planning. It is important to ensure you get the right services for your unique needs. Here are some guidelines to help you select the right financial adviser.

There are two options for fee-based and commission-based advisors

Both types of advisor have their pros and cons. A commission-based advisor might be a good option if you have the funds to pay for their services. If you don't buy any financial products, however, you may not be required to pay their fee. A commission-based financial advisor might be the best option if you are only interested in long-term investments.

Investing with a financial advisor

If you are looking for smart investments, a financial advisor could be the right person to help you. You should be aware of the costs associated with hiring an adviser. The fees and commissions a financial advisor may charge are not only the fees. Although the fees you pay may be offset by the investment advice you receive, fees charged by financial advisors can add up to 2% to your annual cost.

Creating a personal budget without a financial advisor

Many people find it difficult to create a budget. This involves setting a realistic budget that you stick to. It is a good idea for people who are trying to reduce debt and save money for the future. This article will provide some basic tips and tricks to get started. Learn how to create a personal financial plan and get started on your journey towards achieving your goals. A personal budget can have many benefits.

FAQ

What is risk management in investment management?

Risk Management is the practice of managing risks by evaluating potential losses and taking appropriate actions to mitigate those losses. It involves the identification, measurement, monitoring, and control of risks.

Investment strategies must include risk management. The goal of risk-management is to minimize the possibility of loss and maximize the return on investment.

The key elements of risk management are;

-

Identifying the sources of risk

-

Monitoring the risk and measuring it

-

How to reduce the risk

-

How to manage the risk

How does Wealth Management Work?

Wealth Management allows you to work with a professional to help you set goals, allocate resources and track progress towards reaching them.

Wealth managers can help you reach your goals and plan for the future so that you are not caught off guard by unanticipated events.

They can also prevent costly mistakes.

What is retirement planning?

Financial planning includes retirement planning. It helps you plan for the future, and allows you to enjoy retirement comfortably.

Retirement planning includes looking at various options such as saving money for retirement and investing in stocks or bonds. You can also use life insurance to help you plan and take advantage of tax-advantaged account.

What is a Financial Planning Consultant? And How Can They Help with Wealth Management?

A financial planner will help you develop a financial plan. They can look at your current situation, identify areas of weakness, and suggest ways to improve your finances.

Financial planners can help you make a sound financial plan. They can advise you on how much you need to save each month, which investments will give you the highest returns, and whether it makes sense to borrow against your home equity.

Most financial planners receive a fee based upon the value of their advice. However, planners may offer services free of charge to clients who meet certain criteria.

Who Should Use a Wealth Manager?

Anyone looking to build wealth should be able to recognize the risks.

For those who aren't familiar with investing, the idea of risk might be confusing. Poor investment decisions can lead to financial loss.

It's the same for those already wealthy. They may think they have enough money in their pockets to last them a lifetime. But they might not realize that this isn’t always true. They could lose everything if their actions aren’t taken seriously.

Everyone must take into account their individual circumstances before making a decision about whether to hire a wealth manager.

What are the benefits associated with wealth management?

Wealth management's main benefit is the ability to have financial services available at any time. It doesn't matter if you are in retirement or not. This is also sensible if you plan to save money in case of an emergency.

You can invest your savings in different ways to get more out of it.

You could, for example, invest your money to earn interest in bonds or stocks. To increase your income, property could be purchased.

A wealth manager will take care of your money if you choose to use them. This will allow you to relax and not worry about your investments.

Is it worth employing a wealth management company?

Wealth management services should assist you in making better financial decisions about how to invest your money. It should also advise what types of investments are best for you. You'll be able to make informed decisions if you have this information.

But there are many things you should consider before using a wealth manager. Do you feel comfortable with the company or person offering the service? Are they able to react quickly when things go wrong Can they clearly explain what they do?

Statistics

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

External Links

How To

How to Beat Inflation with Investments

Inflation will have an impact on your financial security. It has been evident that inflation has been rising steadily in the past few years. Different countries have different rates of inflation. India, for instance, has a much higher rate of inflation than China. This means that you may have some savings, but not enough to cover your future expenses. You could lose out on income opportunities if you don’t invest regularly. So how should you deal with inflation?

Stocks investing is one way of beating inflation. Stocks offer you a good return on investment (ROI). These funds can be used to purchase gold, silver and real estate. There are some things to consider before you decide to invest in stocks.

First, decide which stock market you would like to be a part of. Do you prefer small or large-cap businesses? Decide accordingly. Next, determine the nature or the market that you're entering. Are you looking at growth stocks or value stocks? Next, decide which type of stock market you are interested in. Then, consider the risks associated to the stock market you select. There are many kinds of stocks in today's stock market. Some are dangerous, others are safer. Take your time.

Get expert advice if you're planning on investing in the stock market. Experts will help you decide if you're making the right decision. Make sure to diversify your portfolio, especially if investing in the stock exchanges. Diversifying your portfolio increases your chances to make a decent profit. If you only invest in one company, then you run the risk of losing everything.

You can always seek out a financial professional if you have any questions. These experts will help you navigate the process of investing. They will ensure you make the right choice of stock to invest in. They will help you decide when to exit the stock exchange, depending on your goals.