You should first ask yourself if you really need to make a personal financial checklist before you create one. There are many reasons you might want to create one. The following tips will assist you in getting started, no matter if you're just looking to get some direction or want more information. Continue reading to find out more about what items you should include and how to organize your personal financial checklist. These are the steps you can take to improve your financial health.

Before you start a personal financial checklist, here are some questions to consider

A personal finances checklist is a great way of assessing your financial situation prior to the end. If you have recently received a raise or withdrawn money from a retirement account, you should consider the tax implications of the influx. If your income is less than your expenses, it could put you in a higher tax bracket. A financial checklist helps you to plan your finances and pay your taxes.

Here are some steps to help you improve your finances

Changes to your finances can seem overwhelming. You don't have to spend hours trying to improve your financial situation. Set specific goals to get started. Financial goals that are both measurable and achievable will be the most effective. You can determine how much money you will need each year to save for retirement. It is a good idea to save at the least 1% of your income each year. After you have determined your goals, you should make sure to achieve them.

A personal finance checklist should include the following items

Before the holidays come, take the time to reflect on your personal financial situation. This includes goals for saving, risk management, net worth, estate planning, and taxes. An investment portfolio audit may be something you might consider. Although these financial activities are easy to do, they require patience and time. A personal finance checklist is a great tool to help you get through the process. Here are five steps to creating a financial planning plan.

Structure of a checklist for personal finances

You can save money by creating a personal budget check list. You should limit how many credit cards you have, especially if you don't have a lot of income or other expenses. If you are constantly overspending, add more discipline to your budgeting. You can also use a personal finance check list to keep track of your spending. You should start using a personal financial check list if you don't already.

Tracking retirement progress

Including the topic of retirement on your finance checklist can be a great way to plan for your future. You should have emergency savings in place in order to protect yourself from personal disasters. It can be helpful to have emergency funds that you have set aside in order to pay bills or cover medical costs. A three- to six month salary emergency fund should be established.

FAQ

What are the most effective strategies to increase wealth?

You must create an environment where success is possible. It's not a good idea to be forced to find the money. If you aren't careful, you will spend your time searching for ways to make more money than creating wealth.

Also, you want to avoid falling into debt. It is tempting to borrow, but you must repay your debts as soon as possible.

You're setting yourself up to fail if you don't have enough money for your daily living expenses. Failure will mean that you won't have enough money to save for retirement.

Therefore, it is essential that you are able to afford enough money to live comfortably before you start accumulating money.

How to Start Your Search for a Wealth Management Service

You should look for a service that can manage wealth.

-

Reputation for excellence

-

Locally based

-

Offers free initial consultations

-

Provides ongoing support

-

Is there a clear fee structure

-

A good reputation

-

It is simple to contact

-

You can contact us 24/7

-

Offers a range of products

-

Low fees

-

Do not charge hidden fees

-

Doesn't require large upfront deposits

-

A clear plan for your finances

-

A transparent approach to managing your finances

-

This makes it easy to ask questions

-

Have a good understanding of your current situation

-

Understand your goals and objectives

-

Would you be open to working with me regularly?

-

You can get the work done within your budget

-

A good knowledge of the local market

-

You are available to receive advice regarding how to change your portfolio

-

Is available to assist you in setting realistic expectations

How old do I have to start wealth-management?

Wealth Management should be started when you are young enough that you can enjoy the fruits of it, but not too young that reality is lost.

The sooner that you start investing, you'll be able to make more money over the course your entire life.

If you are planning to have children, it is worth starting as early as possible.

If you wait until later in life, you may find yourself living off savings for the rest of your life.

What are some of the benefits of having a financial planner?

A financial plan is a way to know what your next steps are. You won't be left wondering what will happen next.

This gives you the peace of mind that you have a plan for dealing with any unexpected circumstances.

A financial plan can help you better manage your debt. If you have a good understanding of your debts, you'll know exactly how much you owe and what you can afford to pay back.

Protecting your assets will be a key part of your financial plan.

Do I need a retirement plan?

No. All of these services are free. We offer free consultations to show you the possibilities and you can then decide if you want to continue our services.

Statistics

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

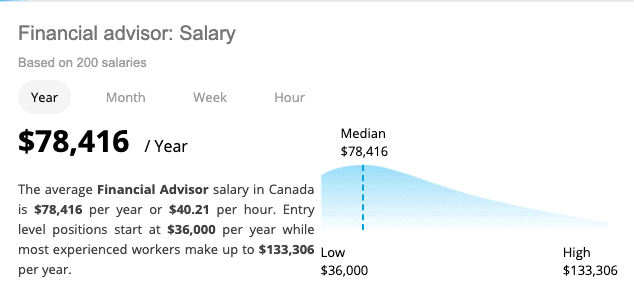

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

External Links

How To

How to save money when you are getting a salary

Saving money from your salary means working hard to save money. These are the steps you should follow if you want to reduce your salary.

-

It's better to get started sooner than later.

-

It is important to cut down on unnecessary expenditures.

-

Use online shopping sites like Flipkart and Amazon.

-

Do your homework in the evening.

-

Take care of your health.

-

Your income should be increased.

-

You should live a frugal lifestyle.

-

You should always learn something new.

-

Sharing your knowledge is a good idea.

-

Regular reading of books is important.

-

You should make friends with rich people.

-

You should save money every month.

-

Save money for rainy day expenses

-

It's important to plan for your future.

-

Do not waste your time.

-

Positive thoughts are best.

-

Negative thoughts should be avoided.

-

God and religion should be given priority

-

It is important to have good relationships with your fellow humans.

-

Enjoy your hobbies.

-

Be self-reliant.

-

Spend less money than you make.

-

It is important to keep busy.

-

Patient is the best thing.

-

Remember that everything will eventually stop. It's better to be prepared.

-

You shouldn't ever borrow money from banks.

-

Try to solve problems before they appear.

-

You should try to get more education.

-

Financial management is essential.

-

It is important to be open with others.